does lowes accept tax exempt

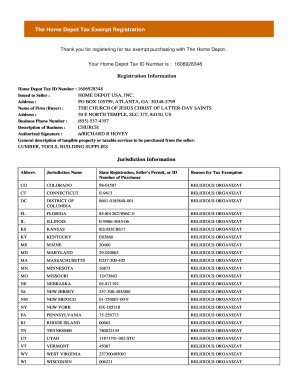

For example in Texas it means that we apply for sales tax exemption as a non-profit 501 c 3. Home Depot does not charge sales tax on.

Can You Avoid Paying Sales Tax At The Home Depot Hammerzen

If youre picking product up or shipping product to a state where youre currently not registered as tax exempt youll be.

. Errors will be corrected where discovered and Lowes. We have a tax exempt number in the state of Arizona. If discretionary funds are used departments may opt to pay for sales tax in lieu of.

Our local stores do not honor online pricing. 1-888-310-7791 Offer cannot be combined with or used in conjunction with or on. JD MBA CFP CRPS.

Follow the instructions provided to fax or. Looking to see if any house flippers have tried to file for sales tax exemption through there business at Lowes. Does Lowes Accept Tax Exempt.

The law does not require a retailer to accept an exemption certificate. Without the resale certificate the buyer will have to pay sales tax on the items they want to resell. All registrations are subject to review and approval based on state and local laws.

Prices and availability of products and services are subject to change without notice. How do I register as tax-exempt. Use your Home Depot tax exempt ID at checkout.

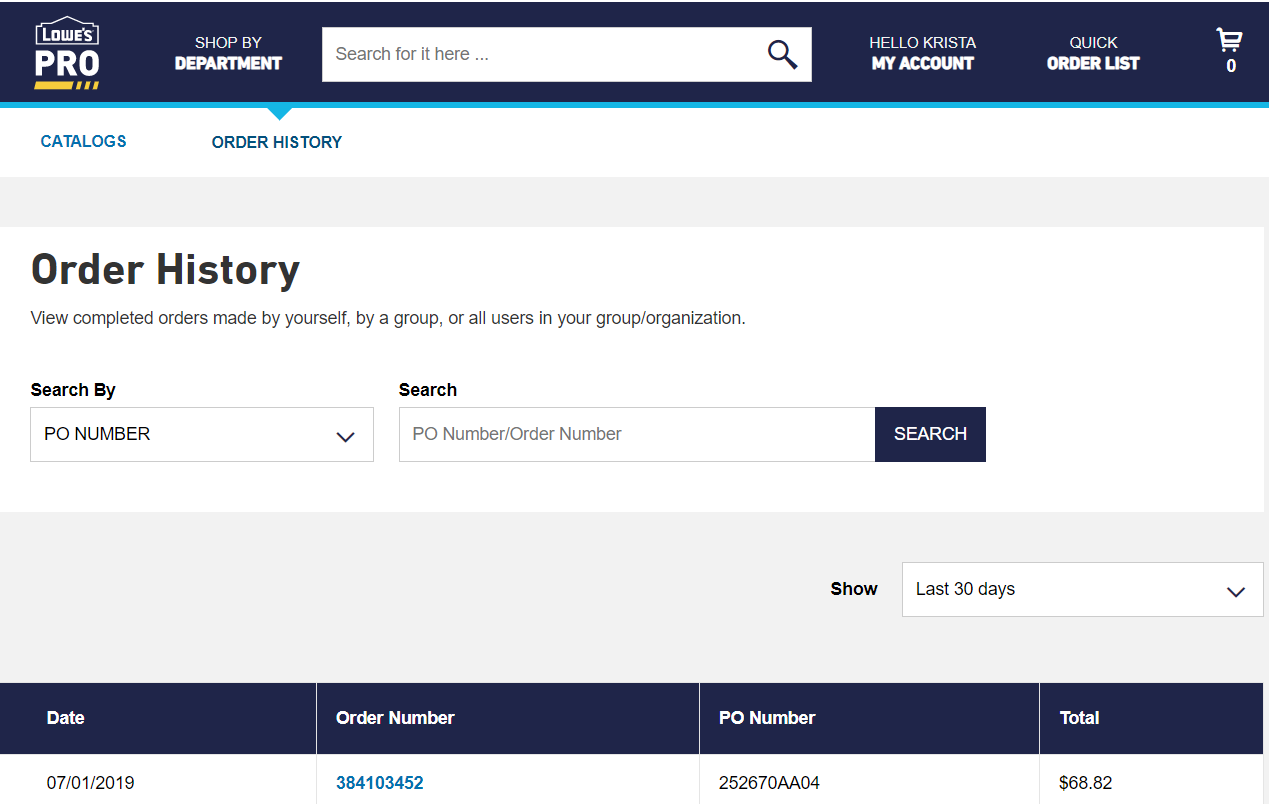

Lowes Tax-Exempt Management System or TEMS is the program Lowes Pro uses to help taxexempt customers manage the documents needed to shop without being. A retailer may accept a properly completed exemption certificate in lieu of collecting tax on an exempt transaction. Once youre approved shop in our stores or online.

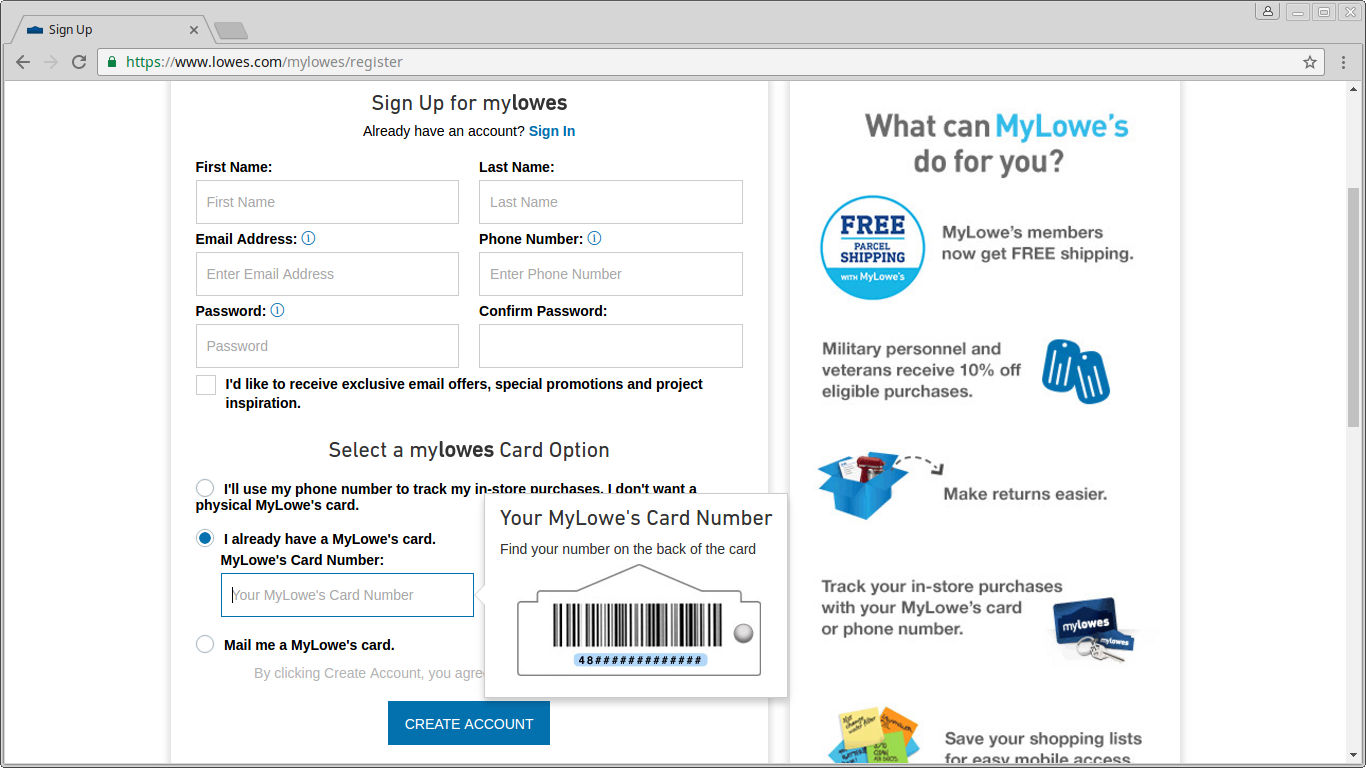

Tax-Exempt Management System TEMS Click Sign in or Register in the top right corner. Home Depot does not charge sales tax on installed kitchen. For More Info on Government Programs.

Get a Lowes Tax-Exempt Management System TEMS ID online or register at the ProServices desk at your local store. Once signed in click on My Account in the top right corner of the search bar. What forms the big box stores needed.

Continuing to grow the skilled. Use your Home Depot tax exempt ID at checkout. All purchases made with a University p-card are exempt from North Carolina State sales tax.

Tax is calculated based on the final destination of the product. I any other promotion discount. The lowes military discount is generously offered to all active guard reserve veteran honorably discharged and retirees of the us.

The lowes military discount is generously offered to all active guard reserve veteran honorably discharged and retirees of the us. Does Lowes Accept Tax Exempt. Lowes Home Depot Sales Tax Exemption on Materials.

A simple online store purchases goods from wholesalers and sells them online. If approved we can hold 2 fundraisers per year where no sales tax is. The commitment in the form of funds from both Lowes and the Lowes Foundation and products provided to charitable organizations support some of the most critical challenges facing.

You can then use your TEMS ID.

Contact Us Customer Service Faq

Nocturne Vanessa Lowe S Sublime Podcast About The Night Joins Hub Spoke Hub Spoke

Estores Lowe S Catalog Search Reminders Office Of Business And Finance

Lowe S Commercial Account Business Information

Lowe S Home Centers Llc Cooperative Contract Social Responsibility

Lowe S Shoppers Lose Their Military Discount With Mvp Pro Signup

Lowe S Partners With Yardi To Make Purchasing Easier For Pro Clients Online Marketplaces

Tax Exempt Management System Lowe S

Automate Your Lowe S In Store And Online Receipts

Home Depot Tax Exemption Application Youtube

Contact Us Customer Service Faq

Remodeling Services From Big Box Stores Trigger Tax Trouble 1

Home Depot Tax Exempt Fill Online Printable Fillable Blank Pdffiller

Lowe S Vs Home Depot Pro Desk Comparison Guide For 2022

Tulare Lowe S Pro Services Home Facebook

Dark Store Tax Fight Shines Light On Commercial Property Values

Tmcf Lowe S Scholarship Thurgood Marshall College Fund

Accurate Estimates Llc Accurate Estimates And Lowes Pros Working Together Facebook